Debt in wartime

Debt deflation and anti-deflation

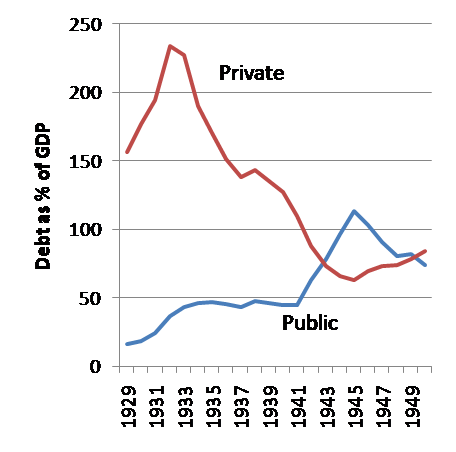

Debt deflation and anti-deflationOne way to look at our current predicament is through the lens of Irving Fisher’s theory of debt deflation: as everyone tries to work off excessive debt, the combination of a contracting economy and falling prices puts everyone deeper in the hole. But how do you get out? I’ve drawn the above chart using debt data from Historical Statistics of the United States Millennial; it shows the debt-deflation spiral of 1929-1933, and the partial recovery of the New Deal years.

It also shows something I haven’t seen emphasized: the role of WWII in cleaning up private-sector balance sheets. During the war years there was very little private borrowing, thanks at least in part to wartime restrictions; meanwhile there was both strong economic growth and a lot of inflation. The result by the war’s end was a very low private debt level relative to GDP.

How big a role did these improved balance sheets play in the fact that the postwar economy didn’t fall back into depression?"

Your comment is awaiting moderation.

From a monetary point of view, we need to cause inflation, which is why I was wondering why we’re being so timid. It seems that the longer debt-deflation goes on, the harder it will be to get inflation going, and the harder it will be to control it.

I was hoping that we could keep WW II out of this, largely because I think that the context of WW II cannot, thankfully, be replicated now. In lieu of that, we’re stuck with trial and error, which is why I thought that there weren’t enough incentives in the stimulus plan. We’re in the unfortunate circumstance of having to try a little bit of this, and a little bit of that, which is why I don’t find trying to pretend that we know exactly what will work very convincing.

One more point. Since we’re not facing WW II, there’s a tendency to downplay the possibility of social strife if unemployment keeps going. This is a mistake. We’re going to need to be very generous in social safety net expenditures, which is where I believe the stimulus should really be targeted. People who are assuming business as usual don’t understand debt-deflation and its consequences. As well, not coming to or accepting a compromise, in the face of a possible unemployment deluge, is the absolute worst kind of politics. The opposite of the kind of politics Burke believed in. As a Democrat, I’m now claiming Burke, a Whig, as an important guide in our politics. As Burke said:

“Mere parsimony is not economy. Expense, and great expense, may be an essential part in true economy.”

“You can never plan the future by the past.

* Letter to a Member of the National Assembly (1791)”

“All government, indeed every human benefit and enjoyment, every virtue, and every prudent act, is founded on compromise and barter. ”

We might well need Burke more than economists, even my hero Fisher.

— Don the libertarian Democrat